By : templates.office.com

Funding should be clearer in order to raise additional capital. It is desirable to estimate monthly. You will find lots of activities to create a prosperous budget.

As said tomorrow, you are able to manage your financial plan and create budget goals by creating one. If you bring it to the budget, you need to have a real financial picture. Owning a budget also allows you to do what you earn for your salary or more for your livelihood. If you get a budget, you’re not the only real person to have an impact.

This is only possible thanks to a small study. Monthly funding is assumed to be among the most appropriate accounting instruments. Create quite easy funding that you can stay with.

Hosted VoIP wants to help you save you in 2018. You should request a budget before making the necessary purchases. For those who receive a budget, you would also like to be exposed to your identity to make uncertain and difficult decisions throughout your life.

If you want to make a living, you don’t believe where it starts. Try the funding tool. So you need a family group to make sure you can maintain a balance of money. Here is one important thing that I have to personally present to your requirements. Using a family group, you can also consider whether your real estate funds are moving. That means you can see where you want your hard earned money. Describe how family finances should differ from personal circumstances.

Whether you want to spend less or not, you still want to involve them in some holidays. Obviously, in this case, if you decide to invest considerably less, you need to use extra capital to get different parts of a different financial plan than to convert cash only to absolutely essential elements of budgeting. File-sharing users become physically individuals who provide relevant information about their funding. About file-level funds will teach you how to discuss a few simple questions. The moment you find out how this extra capital is brought to your budget, you will find out where you really go.

After a while you need to use the templates in our future section to recognize the amount of cash load associated with a huge purchase. They can be valuable when trying to reduce or save your current workload. You will find different types of templates for more than one type of easy-to-use template that is created for a wider range of software and consists of fiscal deals that you can get in most ordinary homes. You will find many hundreds of templates to choose from, as well as many formulations that are sorted from common types and are planning to create an investigation of data is much easier.

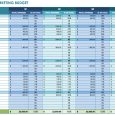

monthly financial budget template

By : www.pinterest.com

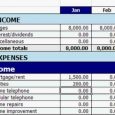

Personal monthly budget

By : templates.office.com

monthly financial budget template

By : www.pinterest.com

monthly personal budget template personal monthly budget template

By : hatunugi.com

monthly financial budget template

![Need to personalize more]MONTHLY BUDGET TEMPLATE! | Ørgåńīžė Need to personalize more]MONTHLY BUDGET TEMPLATE! | Ørgåńīžė](https://hairfad.com/wp-content/uploads/2019/08/monthly-financial-budget-template-acef4bef13db8af7995160f95d174c87-household-budget-template-monthly-budget-printable.jpg)

By : www.pinterest.com

Similar Posts:

- Monthly Budget Template Excel

- Monthly Family Budget Template

- How To Create A Budget Template

- Couples Monthly Budget Template

- Free Download Budget Template

- Personal Monthly Budget Template Pdf

- Family Monthly Budget Template

- Microsoft Excel Monthly Budget Template

- Monthly Personal Budget Template

- Weekly Budget Template Printable

- Monthly Budget Template

- Make A Budget Template

- Income Budget Template

- Personal Home Budget Template

- Zero Dollar Budget Template

- Personal Expense Budget Template

- Finance Budget Template

- Free Printable Monthly Budget Template

- Personal Annual Budget Template

- Personal Finances Budget Template

- Excel Personal Budget Template